Choosing car insurance is more than a price tag; it’s about reliability, service, and knowing you’re protected when life throws a curveball. In San Diego, drivers face a mix of dense urban streets and coastal weather, which makes selecting the right policy a practical and sometimes emotional decision. This guide walks through practical steps, common pitfalls, and how to align your coverage with your everyday needs. By focusing on value, responsiveness, and clear terms, you’ll feel confident navigating the options available to you in your neighborhood.

Understanding your options starts with a realistic look at what you drive, how you use it, and who is behind your coverage. You’ll want to balance liability limits, deductibles, and extra protections like roadside assistance or rental car coverage. The right approach is to map out scenarios you’re likely to encounter, from daily commutes to weekend road trips, and then compare how different plans respond in those moments. Being organized lets you cut through marketing language and focus on what truly matters when you need support.

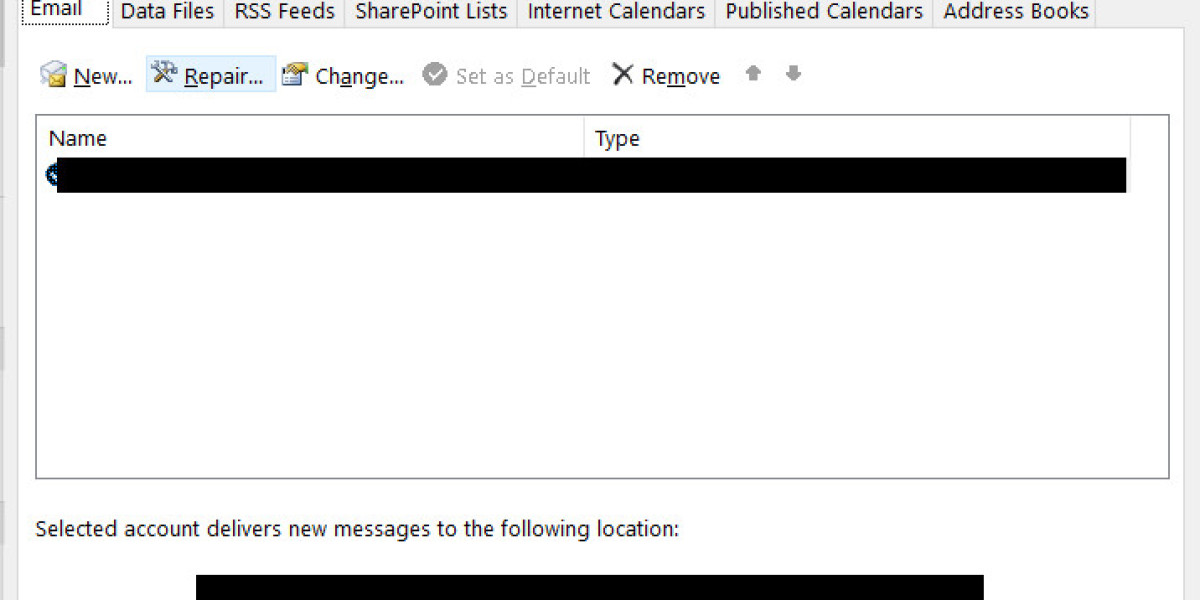

A practical starting point is to compare quotes from multiple providers while also evaluating each company’s reputation for customer service. In the process, many drivers in San Diego discover that price alone isn’t enough; you’ll want a policy that travels with you through bumps on the road or a sudden claim. Focus on a plan that offers straightforward messaging, accessible agent support, and reasonable handling times so you’re not left waiting for answers when coverage is needed most.

How pricing reflects real-world value in car insurance san diego

For residents evaluating car insurance san diego know that pricing is important, but long-term value comes from how a policy handles claims and customer support car insurance san diego during a claim. Understanding your deductibles, premiums, and coverage limits helps you see where a plan saves money and where it could cost more later. You’ll also want to consider how discounts, bundling options, and safe-driving programs stack up with the coverage you actually use.

In addition, evaluating each insurer’s claim-handling record matters, because the fastest path to peace of mind is a smooth, transparent process after an loss occurs. When you look beyond the sticker price, you’ll notice differences in app usability, online document submission, and the speed at which adjusters respond. A thoughtful review of these details will help you pick a provider that aligns with your expectations for everyday service and occasional emergencies.

Evaluating an auto insurance company San Diego for local needs

Choosing an auto insurance company San Diego involves more than national reputations; it’s about neighborhood responsiveness and the kind of guidance you receive when you ask questions. A strong local partner often offers tailored endorsements for typical driving patterns, like urban parking hazards or coastal weather impacts that can affect your vehicle’s condition. That local touch can translate into fewer surprises when you need to file a claim or adjust your policy after a life change.

Look for agents who take time to listen and explain options clearly, and for an online experience that makes policy management straightforward. The right company in San Diego will also provide accessible resources, such as budget-friendly payment plans or a clear path to upgrade coverage as your life evolves. By assessing how well a provider communicates and supports you in real-world situations, you’ll build confidence that you’re with a company that has your back.

Planning coverage that fits auto insurance San Diego realities

As you read policy details for auto insurance San Diego, you’ll want to connect the coverage you see with the realities of your everyday driving. Think about liability limits that reflect your risk tolerance and asset protection, combined with deductibles you can comfortably handle in a pinch. If you frequently rely on a rental car during repairs, confirm that rental reimbursement is included or available as an add-on, because that can save you time and stress after an collision.

Another practical consideration is protection against uninsured or underinsured motorists, which can be particularly relevant in busy coastal corridors and highway on-ramps. You’ll also want to review medical payments or personal injury protection in light of your health coverage and family needs. The goal is a balanced package that minimizes out-of-pocket costs while maintaining flexibility if your driving patterns shift.

Negotiating with providers while keeping long-term value in mind

When negotiating with an auto insurance company San Diego or any local provider, the focus should be on terms you actually understand and can rely on. Ask for examples of recent claim scenarios and how the company resolved them, including timelines and any standards they follow. A transparent discussion about how discounts are earned and how premium changes may occur with changes in vehicle usage will help you forecast future costs more accurately.

In parallel, verify whether the insurer offers value-added services such as 24/7 road assistance, digital claim submission, or a clear appeals process if you disagree with an adjustment. A reliable partner will present these details upfront, without pressure or opaque language. This approach keeps the relationship constructive and centered on helping you stay protected and informed over the life of your policy.

A practical path to long-lasting coverage in San Diego

In the end, securing a solid car insurance plan for your San Diego life comes down to aligning available products with your real-world needs and financial realities. Start by listing your must-haves, like reliable claim support, speed of service, and the ability to adjust coverage as your circumstances change. Then, systematically compare how each option stacks up against that list, including any local perks that smaller providers might offer.

Your decision should feel empowered rather than overwhelmed, with a clear sense of what you’re paying for and why it matters. When you choose an auto insurance plan that fits your everyday rhythm, you’re investing in steadier protection and greater peace of mind in the busy streets and scenic drives that define this region.

Conclusion

Selecting the right policy means balancing cost with clarity, service, and local relevance. By evaluating claims handling, coverage options, and the human side of customer support, you’ll find coverage that suits your San Diego lifestyle. This approach helps ensure you’re protected when you need help most, while keeping ongoing costs predictable and fair.